Best News For Picking Bohemia Gold Bullion

Wiki Article

What Should I Think About Prior To Investing In Gold Coins/Bullion?

Consider these factors when investing in bullion and gold coins in the Czech Republic: Reliable sourceGold coins can be purchased from reliable sources. Recognized organizations or dealers who are authorized to sell ensure authenticity and high quality.

Purity & Weight- Verify that the gold is pure and weighs. Gold bullion comes in various weights and purity levels (e.g. 22, 24 and so on.). It has to meet the standard requirements.

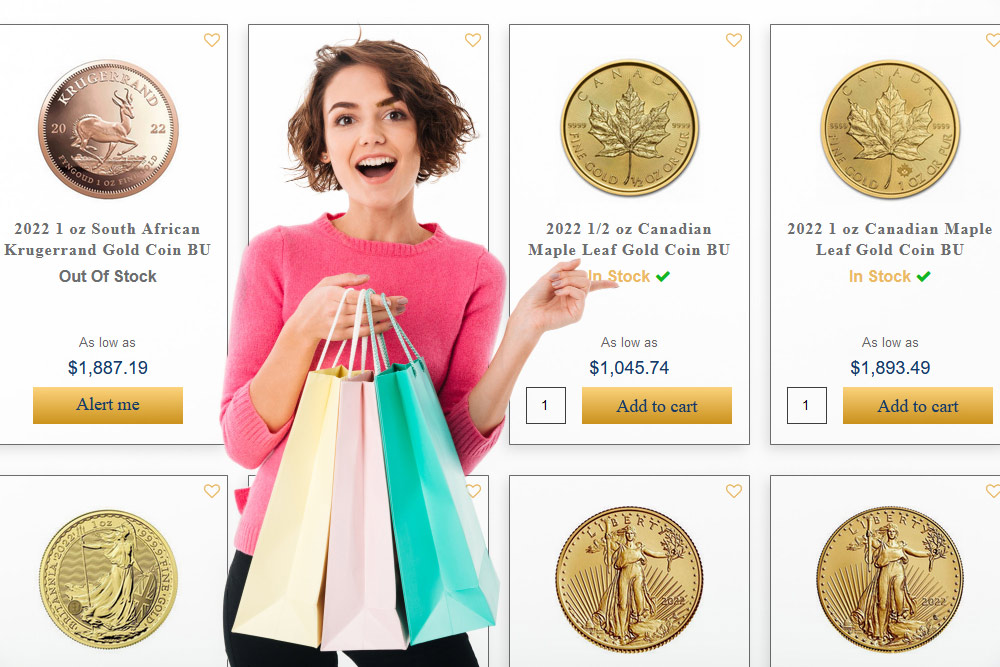

Pricing and Premiums- Understand the pricing structure that governs the price at which gold is traded and any additional fees charged by dealers. Compare prices with sellers to find the most profitable investment.

Security and Storage- Think about safe and secure storage options for your gold. Security concerns are the main reason for some investors to choose to store their gold in a bank.

Selling Options and Liquidity Examine the ability to sell when you need to. Choose coins or metals that are simple to sell and have high liquidity. Check out the most popular buy Prague gold bullion examples for site examples including nationwide gold and bullion reserve, buy gold bullion, gold and bullion, 50 pesos gold coin, gold bullion for sale, gold apmex price, purchase physical gold, cost of gold coins, good gold stocks, gold ira best and more.

How Do I Know If The Gold I Buy Has Proper Documentation And Certificates Of Authenticity?

To ensure that the gold you purchase is accompanied by proper documents and authentic certificates Follow these steps

Verify the authenticity of your certificate by requesting verification options. Some certificates contain verification codes or numeric numbers, which you can check online or via phone. These options are a way to confirm the authenticity of your certificate. Ask for advice from third-party experts. might want to seek out advice from appraisers and graders who are independent. They can help verify the authenticity of the document by examining the papers and the gold piece.

Compare to Standards Known- Compare the documentation provided with industry standards known or sample certificates issued by reputable sources. This will help detect any inconsistencies and irregularities.

Purchase gold from reputable and trusted dealers. These sellers are known for their honesty and trustworthiness.

Keep all documents, receipts and certificates to be used in the future.

By actively seeking out and scrutinizing all documentation that is provided by comparing the data to industry standards, and consulting an expert when needed, it's possible to ensure that gold bought comes with genuine certifications of authenticity. Check out the top rated coins Bohemia examples for more tips including kruger rand, gold mutual funds, valuable gold dollar coins, american eagle gold coin price, purchase gold bar, gold sovereign coins, gold american eagle price, 20 dollar coin, gold one dollar coin, 2000 p sacagawea dollar and more.

What Is A High-Priced Mark-Up In The Market For Stocks?

In the context gold trading and trading, the words low markup or low spread refer to the price of buying and selling gold when compared with the current market value. These terms describe the amount you'll pay for gold, whether in the form of a markup or a spread. Low Mark-up - Dealers will charge a minimal premium or cost above the current price of gold. A low mark-up implies that the price you pay for purchasing gold is close to or just a little higher than the current market value.

Low Price SpreadPrice spread is the difference between the selling and buying prices (ask and bid) for gold. Spreads with low price points to only a tiny gap between the two prices. This means there is a smaller difference in the price you pay to buy gold, compared to the price you can sell it for.

What Are The Mark-Ups And Price Spreads Differ Among Different Dealers In Gold.

Negotiability Certain dealers are more inclined to negotiate markups and margins, specifically for big transactions or customers who are repeat clients. Geographical location: The mark-ups as well as the spreads may vary depending on local tax rates, regulations and other regional aspects. For instance, dealers in areas with higher tax rates or costs for regulatory compliance may transfer these costs to their customers through higher mark-ups.

Product Types and Availability Spreads and mark-ups can differ based on the type of gold-based product (coins, bars, collectibles) as well as their availability. The rarity of collectibles and rare items could result in greater markups.

Market Conditions - During times of high volatility, increased demand, scarcity, or market volatility, dealers may raise their spreads to either mitigate or cover any possible losses.

Investors in gold must do their homework to find the best dealer. They need to compare multiple prices, consider more than just mark-ups and spreads. Additionally, they must consider factors such as reputation and reliability as well as customer service. Comparing prices and getting quotes from different sources will help you find the best deals on gold. Read the top rated gold price Charles III info for blog examples including gold bullion for sale, sacagawea gold dollar, best gold ira, gold one dollar coin, gold coin prices, 1 oz gold coin, american gold eagle, jm bullion gold, gold coins near me, ira investing gold and more.